News

7x24

Quotes

Economic Calendar

Video

Data

- Names

- Latest

- Prev.

Latest Update

Risk Warning on Trading HK Stocks

Despite Hong Kong's robust legal and regulatory framework, its stock market still faces unique risks and challenges, such as currency fluctuations due to the Hong Kong dollar's peg to the US dollar and the impact of mainland China's policy changes and economic conditions on Hong Kong stocks.

HK Stock Trading Fees and Taxation

Trading costs in the Hong Kong stock market include transaction fees, stamp duty, settlement charges, and currency conversion fees for foreign investors. Additionally, taxes may apply based on local regulations.

HK Non-Essential Consumer Goods Industry

The Hong Kong stock market encompasses non-essential consumption sectors like automotive, education, tourism, catering, and apparel. Of the 643 listed companies, 35% are mainland Chinese, making up 65% of the total market capitalization. Thus, it's heavily influenced by the Chinese economy.

HK Real Estate Industry

In recent years, the real estate and construction sector's share in the Hong Kong stock index has notably decreased. Nevertheless, as of 2022, it retains around 10% market share, covering real estate development, construction engineering, investment, and property management.

Market Trend

Popular Indicators

AI Signal

View All

No data

Sign in

Sign up

--

Reminders Temporarily Unavailable

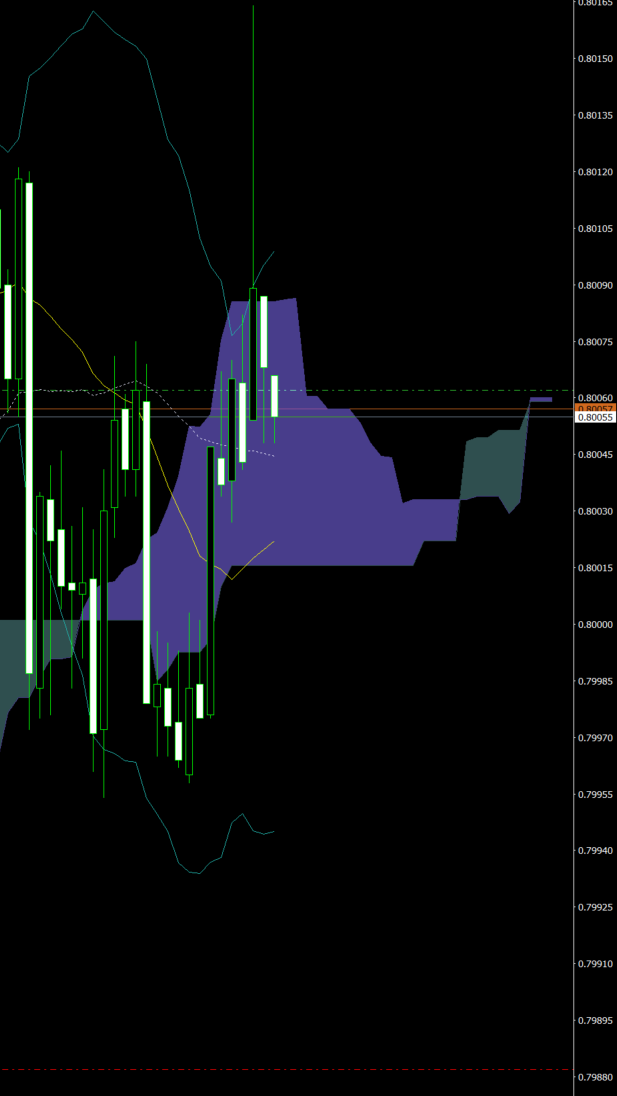

USD/CHF is trading tightly around 0.8005–0.8010, hovering near multi-year lows as the US dollar continues to weaken. Markets maintain strong conviction that the Fed will cut rates in December, while geopolitical uncertainty in Europe is driving renewed safe-haven flows into the Swiss franc...

0.80054

ENTRY

0.79650

TGT

0.80350

SL

296

Points

Loss

0.79650

TGT

0.80352

CLOSING

0.80054

ENTRY

0.80350

SL

Quick Access to 7x24

Quick Access to More Editor-selected Real-time News

Exclusive video for free

FastBull project team is dedicated to create exclusive videos

Real-time Quotes

View more faster market quotes

More comprehensive macro data and economic indicators

Members have access to entire historical data, guests can only view the last 4 years

Member-only Database

Comprehensive forex, commodity, and equity market data

Gerik

Analysts

Primarily focused on selectively reposting top global financial articles, helping readers gain deep insights into the latest market trends, investment strategies, and economic dynamics. By curating high-quality content, it provides readers with comprehensive financial information, ensuring they stay up to date with industry developments.

Rank

6

Articless

203

Win Rate

51.65%

P/L Ratio

1.25

Focus on

EURUSD, XAUUSD

GBP/USD push higher on dollar softness and renewed pound demand

TradingGBP/USD push higher on dollar softness and renewed pound demand

PROFIT +368 PointsDollar–Franc slides toward multi-year lows as USD weakens on firm rate-cut expectations

LOSS -302 PointsAUD/USD spikes on hot Australian GDP

LOSS -435 PointsAUD/USD spikes on hot Australian GDP

LOSS -435 Points